Rosland Capital has many precious metals available for purchase, including gold, silver,

palladium and platinum. Our gold coins include bullion, premium, exclusive specialty and

numismatic options, to meet our customers’ varied choices.

Speak with a Rosland Capital representative at 1.877.211.3021 or visit the Rosland Capital website to learn more about how to buy gold.

Our love of gold is as old as civilization. Flakes of gold have been found in Paleolithic caves

last inhabited 40,000 years ago. Even today, gold artifacts unearthed from thousands of years

ago retain a stunning luster that continues to entrance people of all walks of life.

For thousands of years, gold has served as the solid backing of the world's economies. Nations

and empires staked their success and their ambition on this excellent store of value. Today,

gold still maintains its status as a store of value.

Gold has historically maintained some value, even in times of inflation and economic

instability. Due to this, many people utilize gold as a means to potentially help in protecting

their assets.

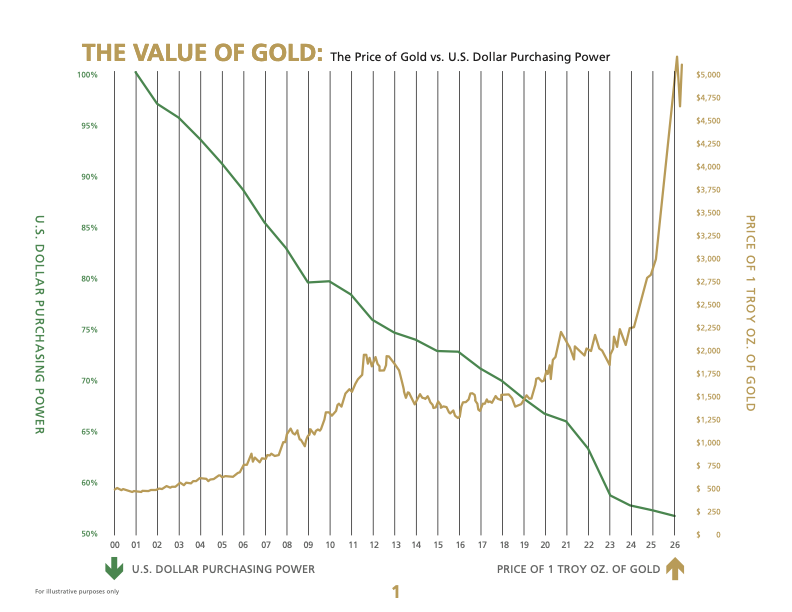

In a world where governments can print money at will, gold has become more than just an asset. The

dollar may gradually lose purchasing power over time, particularly when inflation is high. However,

the real value of gold has held up well, and over time, it's actually grown significantly.

Inflation can devalue the purchasing power of your hard-earned savings and retirement and other

assets. In times when inflation is high, diversifying your assets may help hedge against any

economic repercussions. Gold has often been used to diversify one’s assets and help in potentially

safeguarding one’s retirement savings.

Read more about gold's market performance.

Many gold buyers operate under the belief that physical gold can (or should) only be held in

easily accessible safe deposit boxes. While this is a viable way to own physical gold, it

may not be the only way to potentially benefit from any possible gains in gold prices.

With a gold IRA, you can own physical gold, held by a trusted custodian, and receive tax

benefits for retirement. A distinctive alternative to conventional IRAs, adding gold to your

retirement plan may potentially help in shielding your assets from the effects of economic

fluctuations. Not to mention, gold IRAs offer the added benefits of owning precious metals.

For detailed information on how to help potentially protect your retirement with gold, check

out this guide on gold IRAs from

Rosland Capital.

Rosland Capital Gold offers physical gold in three primary forms: bullion bars, bullion coins, and premium coins. Explore these gold coins from Rosland Capital to see which option may be the most beneficial to you.

Bullion bars are considered the bulk form of physical gold. This is the type of gold you'll

commonly see traded on major markets. Most bullion bars available for public purchase are

forged in one-ounce or ten-ounce sizes, although bars weighing up to 400 ounces (25 pounds)

can also be obtained on occasion. Gold bullion bars are valued by weight, with their value

equivalent to the price of gold per ounce, multiplied by the number of ounces of gold in the

bar (if larger than one ounce).

Learn more about bullion

bars from Rosland Capital.

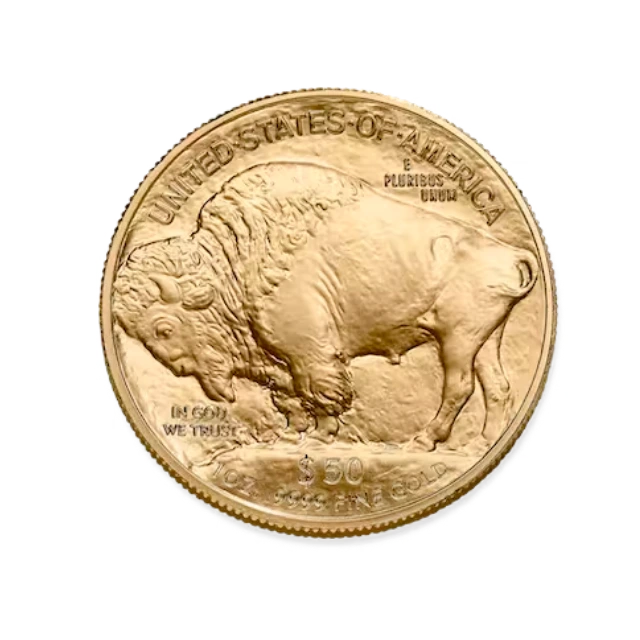

Bullion coins are often minted to the same levels of purity as bullion bars. However, their

value is set in two different ways. Gold bullion coins are commonly valued by weight, but

since they're typically minted by national governments, they are also considered legal

tender and bear a pre-set face value determined when minted.

The metal value of a gold bullion coin will fluctuate based on the price of gold, but the

face value of the coin will remain constant. You can use gold bullion coins to buy things in

stores, but it's almost never a good idea, as the value of the gold used to create the coin

is nearly always greater than the coin’s face value as a medium of exchange. Gold buyers

typically value bullion coins based on the weight of gold they contain.

Check out Rosland Capital’s array of bullion coins

here.

Explore Rosland Capital’s distinctive collection of premium gold coins, including numismatic coins and collectible coins. Rosland Capital has collaborated with a number of world-class organizations including the British Museum, Formula 1®, and the PGA TOUR to create a range of exclusive, specialty coins.

Rosland Capital’s collaboration with the British Museum includes various coins depicting

some of the museum’s most revered pieces such as the Lewis Chessmen figures. The British

Museum Masterpiece Collection also showcases historic helmets.

British Museum Collection - Lewis Chessmen - The Warder

Formula 1 and Rosland Capital present a collection of gold and silver coins celebrating

racing events and prestigious names in motor racing. This collection of Formula 1 gold coins

includes pieces commemorating the FIA Formula 1 World Championship, various Grand Prix races

and some of the greatest racing names such as Michael Schumacher.

Explore the Formula 1 collection

here.

Formula 1® Coin Collection - 2024 Championship 2024-issue

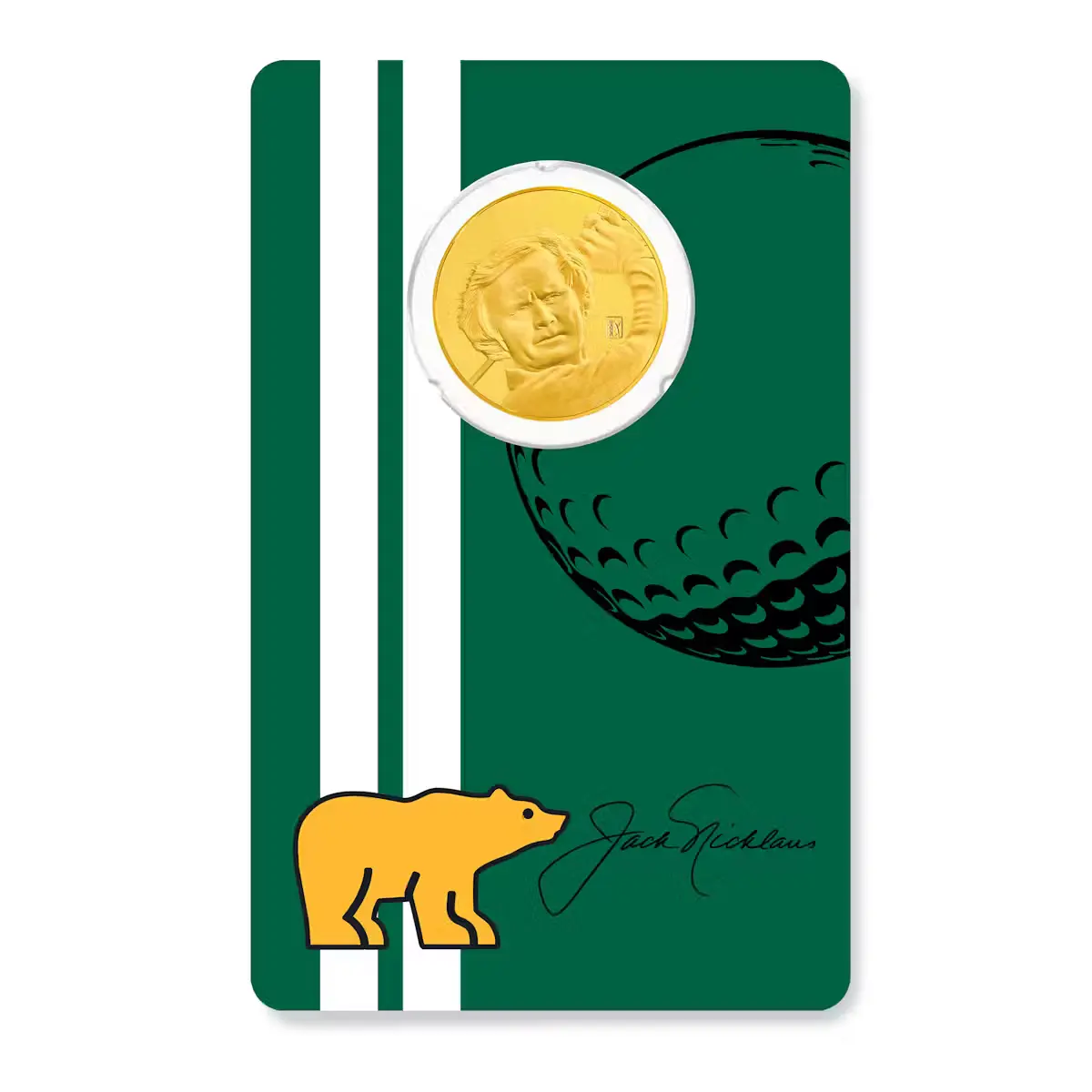

Rosland Capital’s PGA TOUR coin collection honors famed tournaments including the Presidents

Cup and the Players Championship. The collection also includes a series of coins depicting

“The King,” Arnold Palmer, an American golf icon and noted philanthropist, and all-time great

Jack Nicklaus.

View the entire PGA TOUR

collection here.

In association with the PGA TOUR, Rosland Capital now offers the first coin in a collection

honoring Jack Nicklaus, whose record of achievement and sustained excellence within the game are

unmatched.

Jack Nicklaus has 120 professional tournament victories worldwide. View the

Jack Nicklaus ¼-oz Gold Proof Coin here.

Rosland Capital LLC

is a leading precious metals firm based in Los Angeles. Our company was founded in 2008 by CEO

Marin Aleksov and there are

now separate, independent offices in the United Kingdom and Germany. Rosland supplies its

customers with a variety of products made from four popular precious metals:

gold,

silver, platinum, and palladium.

At Rosland, we strive for excellence with every transaction and aim to build long-term

relationships with clients. Our company has an "A+" rating from the Better Business Bureau, a AAA rating from the Business Consumer Alliance, and reviews from over 600 satisfied

customers on Reach150.

In recent years, Rosland has collaborated with esteemed groups like the Swedish-American Chamber of Commerce in our effort to align with

like-minded organizations in our community and to make greater strides toward achieving our

goals. To learn more about Rosland as a business, visit the company’s profiles on Bloomberg and Crunchbase.

Our company is committed to educating the public on the potential benefits of purchasing gold

bullion, gold coins, and other products made from precious metals. In addition to supplementary

educational sites like this one and Rosland Capital IRA, we also developed Buy Gold 101 to provide

a deeper exploration of the potential value gold can bring to your assets.

Rosland’s dedicated customer service representatives are available to address any concerns you

may have at any stage in your gold-buying journey.

Contact our team to learn more about buying gold from Rosland Capital.